Essay Example on Apple: Recommendations

-

Osman Sirin

- November 30, 2022

Recommendations for Apple Inc.

Essay on Apple: Introduction

In today’s world, one can readily observe many international organizations that even have more budgets than many countries. In this sense, the influence and aftermath of such organizations as Apple, Samsung, and Microsoft can be beyond imagination. That is, they employ hundreds of thousands of individuals across the world and exist in almost every country on the map. In this assignment, meticulous research on Apple Inc.’s capital structure and financial risks have been conducted. Along with its main competitors, market performance and financial statement information have been gathered and examined. Accordingly, a few recommendations have been stated.

Body Paragraphs

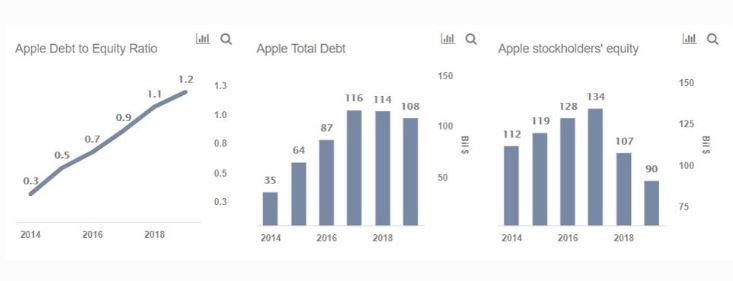

“Apple, Inc. (AAPL) is the largest and arguably the most successful company of the 21st century. From its humble start in 1976 to the more $1.1 trillion company, Apple’s success has come from being a leading innovator, both on finance and technology” (Carmichael, 2020, para. 1). As of June 29, 2019, Apple’s total stockholder’s equity is $96.5 billion, consisting of $43.4 billion of common stock at par value and additional paid-in capital, and $53.7 billion in retained earnings, less accumulated other comprehensive income of $639 million (“Apple Stock,” 2018; Carmichael, 2020). In other words, “Apple has roughly 4.57 billion shares outstanding” (Carmichael, 2020, para. 4). The most important thing is that Apple is considered increasingly thorough and successful when it comes to increasing equity and leveraging debt in terms of its capital structure.

Figure 1. Apple debt-equity ratio, Apple total debt, Apple stockholder’s equity (Team, 2020)

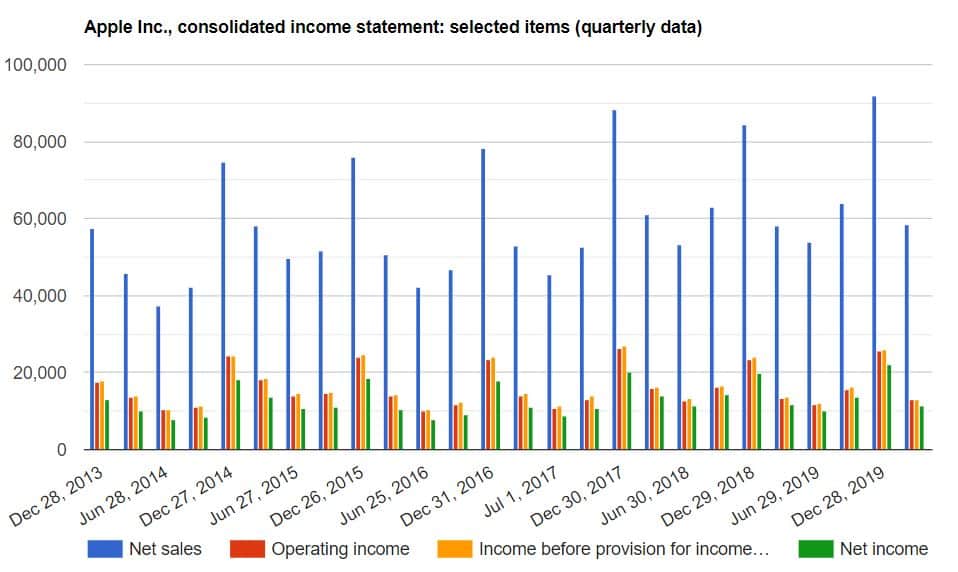

According to the financial statement, Apple Inc.’s “net sales increased from Q4 2019 to Q1 2020 but then decreased significantly from Q1 2020 to Q2 2020” (Dybek, 2020). In terms of operating income, it slightly increased between Q4 2019 and Q1 2020; however, it then drastically decreased between Q1 2020 to Q2 2020 (Dybek, 2020). Similarly, income before provision for income taxes first increased between Q4 2019 and Q1 2020, then drastically decreased between Q1 2020 and Q2 2020 (Dybek, 2020). Finally, Apple’s income slightly increased from Q4 2019 to Q1 2020, but then again, it drastically decreased between Q1 2020 and Q2 2020 (Dybek, 2020). In this sense, one can explain the drastic decrease during the Q1 and Q2 2020 with COVID-19 pandemic across the world. Many international organizations have been hugely affected, including Apple, Samsung, Google, Tesla, and many more well-known organizations.

Figure 2. Apple income statement (Dybek, 2020)

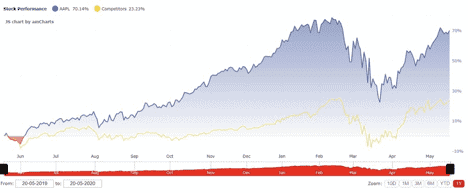

The industries of the company’s products are considered highly competitive. More specifically, Apple faces aggressive competition across the world with emerging and already established large organizations, as shown in Fig. 3. For instance, new companies such as Huawei, Xiaomi, and Oppo have aggressively entered the smartphone markets, especially in developing countries. These companies aim to serve both low- middle- and high-segment customers. They have also aggressively cut the product prices and lowered the profit margin for the industry (“Apple Inc.’s Competitiveness,” 2020). Similarly, “Apple’s digital services have faced significant competition from other companies promoting their own digital music and content services, including those offering free peer-to-peer music and video services” (“Apple Inc.’s Competitiveness,” 2020). Therefore, one can readily infer that the competitive advantage and condition of the company depends highly on its progressive innovation of products and services.

Figure 3. Apple Competition Data (“Apple Inc.’s Competitiveness,” 2020).

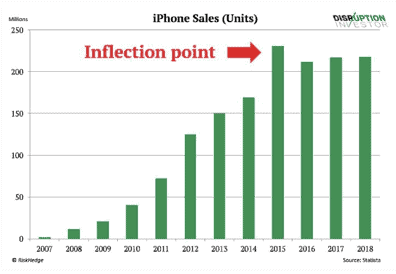

McBride infers that half of Apple’s business is at risk (2019). That is, iPhone sales stalled out, iPhones are more expensive for Apple, too, and there is a strong competitive activity, both on the smartphone and laptop market where Apple has been dominant for decades, but it faces some serious challenges within the last years (“Apple’s Hidden Financial Risks,” 2018; McBride, 2019). Most importantly, the primary income of Apple is the smartphone sales across the world. In this sense, Figure 4 shows the drastic statistics regarding the risks that Apple faces in terms of sales.

Figure 4. iPhone sales statistics (McBride, 2020)

Essay on Apple: Conclusion

Upon analyzing the industry data, the mere and most significant recommendation is that Apple should also concentrate on middle- and low-segment customers like Huawei and Xiaomi for wide profit margin through sales, because these companies start hunting low segment and produce high segment devices after acquiring the brand recognition and reputation. That is, Apple should respond to such strategies. The reason behind decreased financial statistics stem from the emergence of strong competitors across the world, and investors observe these as risks, which return a negative impact on Apple financial. After all, Apple can turn the table quickly by concentrating on middle- and low- segment customers with its already widespread brand recognition and reputation.

References

Apple Inc’s Competitiveness. (2020). Retrieved May 18, 2020.

Apple Stock: Capital Structure Analysis (AAPL). (2018, December 13).

Apple’s Hidden Financial Risks: What You Need to Know. (2018, February 1).

Carmichael, C. (2020, January 29). Understanding Apple’s Capital Structure. Retrieved May 18, 2020.

Dybek, M. (2020, May 2). Apple Inc. (NASDAQ:AAPL): Income Statement (Q). Retrieved from https://stock-analysis-on.net/NASDAQ/Company/Apple-Inc/Financial-Statement/Income-Statement/Quarterly-Data

McBride, S. (2019, December 2). Half Of Apple’s Business Is at Risk. Retrieved May 18, 2020.

Team, T. (2020, February 3). A Closer Look At Apple’s Debt & Changing Capital Structure. Retrieved May 18, 2020.

Contents

Recently on Tamara Blog

Essay on Animal Farm by Orwell – Free Essay Samples

“Animal Farm” by George Orwell is a literary masterpiece that tells the story of a group of farm animals who rebel against their human farmer and establish a socialist community based on the principles of equality and mutual respect (Orwell, 1945). However, over time, the pigs who lead the revolution gradually become corrupted by power and begin to oppress and exploit the other animals, ultimately turning the farm into a totalitarian state.

Essay on Cyberbullying – Free Essay Samples

Bullying is an aggressive behavior that is intentional and repeated, aimed at causing harm or discomfort to a person, and often takes place in social environments such as schools, workplaces, and online platforms. Cyberbullying is a relatively new form of bullying that has emerged with the widespread use of technology and the internet. Cyberbullying refers to bullying behaviors that occur online or through electronic means, such as social media, text messages, and emails.

Essay on Nature vs. Nurture – Free Essay Samples

The debate over nature versus nurture has been a longstanding topic of interest among psychologists and other scholars. The two concepts, nature and nurture, are frequently used to explain human development and behavior.

Lord of the Flies Essay – Free Essay Samples

Veterans have played a critical role in the history of the United States, serving their country in times of war and peace. Despite their sacrifices, many veterans face significant challenges, including physical and mental health issues, homelessness, and unemployment.

Why Veterans Are Important – Free Essay Samples

Veterans have played a critical role in the history of the United States, serving their country in times of war and peace. Despite their sacrifices, many veterans face significant challenges, including physical and mental health issues, homelessness, and unemployment.

American Dream Essay – Free Essay Samples

The American Dream has been a central concept in American culture for decades, representing the idea that anyone, regardless of their background, can achieve success and prosperity through hard work and determination. The concept of the American Dream is rooted in the country’s history and has been promoted in various ways, from the founding fathers’ beliefs to the post-World War II era.